Bridge financing represents one of the most critical funding mechanisms available to startups navigating the unpredictable terrain between major funding rounds. This short-term capital solution serves as a financial lifeline when companies need immediate funds to maintain operations, pursue time-sensitive opportunities, or simply survive until their next significant investment closes. For founders facing cash flow crunches or unexpected delays in securing Series A, B, or later-stage funding, understanding bridge financing can mean the difference between company survival and forced shutdown. The startup funding landscape rarely follows a predictable timeline. Venture capital rounds can take months longer than anticipated, revenue projections sometimes fall short, and market conditions shift without warning.

Bridge financing addresses these realities by providing quick access to capital when traditional funding sources are either unavailable or impractical. Whether a company needs three months of runway to close a delayed round or six months to hit the metrics required for a higher valuation, bridge loans and notes offer flexible solutions tailored to startup needs. By the end of this article, readers will understand exactly how bridge financing works, when it makes strategic sense, the various structures available, and how to negotiate favorable terms. The guide covers everything from basic mechanics to advanced considerations around conversion terms, interest rates, and investor relations. Armed with this knowledge, founders can approach bridge financing discussions with confidence and make informed decisions about whether this funding strategy aligns with their company’s trajectory.

Table of Contents

- What Is Bridge Financing and How Does It Work for Startups?

- Common Situations That Require Bridge Financing for Startups

- Bridge Financing Terms and Structures Founders Must Understand

- Risks and Downsides of Bridge Financing for Startups

- Alternative Funding Options to Bridge Financing

- How to Prepare

- How to Apply This

- Expert Tips

- Conclusion

- Frequently Asked Questions

What Is Bridge Financing and How Does It Work for Startups?

Bridge financing, sometimes called bridge loans or bridge funding, is a short-term financing arrangement designed to provide immediate capital until a company secures more permanent funding or reaches a financial milestone. In the startup context, this typically means funding that covers operational expenses between equity rounds, during acquisition negotiations, or while waiting for committed investment to finalize. The “bridge” metaphor captures the essence of this funding type: it spans a gap between two more stable financial positions. The mechanics of startup bridge financing differ from traditional business loans in several important ways.

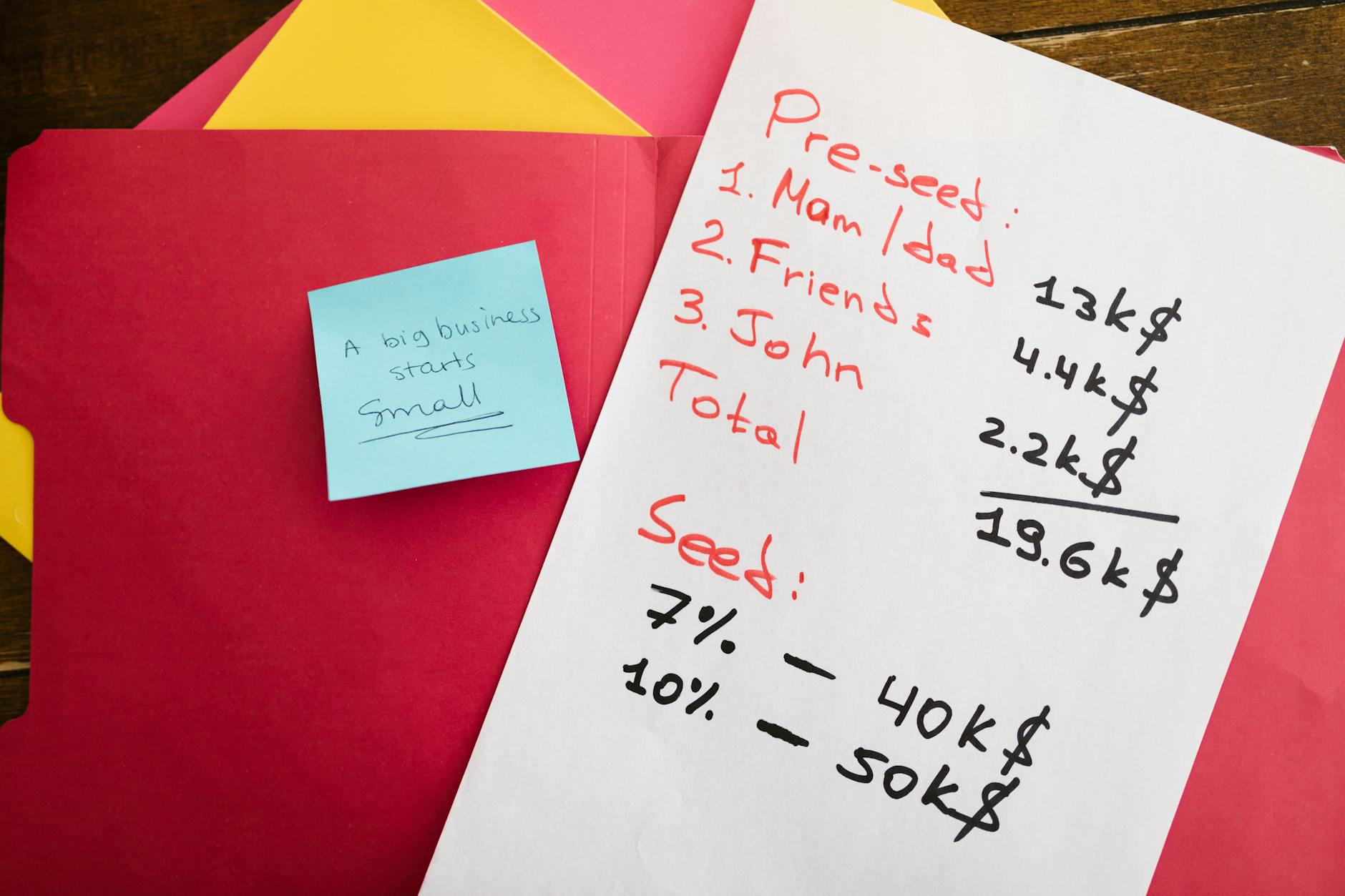

Most bridge financing for venture-backed companies comes in the form of convertible notes or SAFEs (Simple Agreements for Future Equity) rather than traditional debt that requires fixed repayment schedules. These instruments allow investors to provide immediate capital that later converts into equity at the next priced round, usually at a discount ranging from 10 to 25 percent as compensation for the additional risk taken. This structure benefits both parties: founders avoid immediate repayment obligations, and investors gain upside potential while protecting their downside. The timeline for bridge financing typically ranges from 6 to 18 months, with most arrangements structured around anticipated funding events. Terms are negotiated based on company stage, existing investor relationships, market conditions, and the specific circumstances driving the need for bridge capital.

- **Convertible notes** carry an interest rate (typically 5-8 percent) and a maturity date, with principal and interest converting to equity upon a qualifying financing event

- **SAFEs** function similarly but without interest accrual or maturity dates, offering cleaner terms but sometimes less favorable investor protections

- **Traditional bridge loans** with fixed repayment terms exist but are less common in venture-backed startups due to cash flow constraints

Common Situations That Require Bridge Financing for Startups

Startups encounter numerous scenarios where bridge financing becomes necessary or strategically advantageous. The most common situation involves timing gaps between funding rounds. A company might have strong verbal commitments from Series B investors but face a three-month due diligence process while current runway only extends six weeks. Rather than accepting unfavorable terms under pressure or missing payroll, founders can raise a bridge round from existing investors or new sources to maintain negotiating leverage. Metric improvement represents another frequent driver of bridge financing decisions.

Perhaps a startup is close to hitting the revenue milestones or user growth numbers that would justify a significantly higher valuation. Raising a small bridge round to fund another quarter of operations might enable a valuation jump from $20 million to $35 million in the subsequent priced round. This arithmetic often makes bridge financing worthwhile even accounting for dilution and conversion discounts. Strategic opportunities also drive bridge financing decisions. A competitor might become available for acquisition, a key hire might require immediate commitment, or a market window might demand faster product development than current resources allow. Bridge financing provides the agility to capitalize on these moments without the delays inherent in traditional funding rounds.

- **Extended due diligence periods** where committed investors require more time to close

- **Acquisition negotiations** requiring operational continuity while deals finalize

- **Revenue delays** when major contracts or partnerships take longer than projected

- **Market timing considerations** when fundraising conditions are temporarily unfavorable

- **Product development needs** requiring additional runway to reach key milestones

Bridge Financing Terms and Structures Founders Must Understand

The specific terms of bridge financing arrangements significantly impact both immediate costs and long-term equity implications. Conversion discounts represent the most fundamental term, typically ranging from 10 to 25 percent depending on risk level and negotiating dynamics. A 20 percent discount means bridge investors convert their investment into equity at 80 percent of the price paid by new investors in the next round. This discount compensates bridge investors for providing capital during higher-risk periods. Valuation caps add another layer of complexity to bridge financing structures. A cap sets a maximum valuation at which bridge notes convert, protecting investors from scenarios where the next round closes at an unexpectedly high valuation. If a bridge note has a $15 million cap and the Series A prices the company at $25 million, bridge investors convert at the $15 million valuation regardless of the discount. Many bridge instruments include both caps and discounts, with investors receiving whichever mechanism produces more shares. Most Favored Nation (MFN) provisions sometimes appear in bridge financing documents, ensuring that if the company offers better terms to subsequent bridge investors, earlier investors automatically receive those improved terms. This protects early bridge participants from being disadvantaged by later negotiations.

## How to Secure Bridge Financing from Existing Investors Existing investors represent the most natural source of bridge financing for startups with established venture relationships. These investors already understand the business, have conducted due diligence, and possess financial incentive to protect their existing investment from dilution or company failure. Approaching current investors for bridge capital requires different tactics than pitching new investors, focusing more on operational updates and clear articulation of how bridge funds translate to improved outcomes for all shareholders. The conversation with existing investors should begin well before runway becomes critically short. Sophisticated founders maintain regular investor communication and surface potential funding gaps early, giving investors time to evaluate requests without emergency pressure. When making the formal ask, present a clear use of funds, specific milestones the bridge will enable, and realistic projections for the next major funding event. Existing investors respond better to proactive, transparent communication than to last-minute scrambles. Not all existing investors will participate in bridge rounds, and founders should prepare for mixed responses. Some firms have policy restrictions against bridge investments, while others may have concerns about company trajectory. The goal is securing participation from enough current investors to demonstrate continued confidence, potentially attracting new bridge participants to fill any gaps.

- **Interest rates** on convertible notes typically range from 5 to 8 percent annually, accruing until conversion

- **Maturity dates** generally fall 12 to 24 months from issuance, triggering repayment obligations or conversion rights if no qualifying round occurs

- **Qualifying financing thresholds** define the minimum round size that triggers automatic conversion, often set between $1 million and $5 million

- **Pro-rata rights** may be included, guaranteeing bridge investors the opportunity to participate in future rounds

- **Start conversations early**, ideally when six or more months of runway remain

Risks and Downsides of Bridge Financing for Startups

Bridge financing carries meaningful risks that founders must weigh against potential benefits. The most significant concern involves dilution stacking. Between conversion discounts, valuation caps, and accrued interest, bridge investors often receive significantly more equity than the dollar amount of their investment might suggest. When bridge rounds multiply or extend beyond original timelines, cumulative dilution can substantially impact founder ownership and complicate future cap table negotiations. Failed conversions represent another serious risk.

If a company raises bridge financing but fails to close the anticipated equity round before maturity, convertible notes can become immediate debt obligations. Most bridge arrangements include provisions for handling this scenario, but options typically favor investors: they might convert at unfavorable terms, demand repayment the company cannot make, or use the leverage to negotiate significant concessions. Companies that repeatedly extend bridge financing without closing major rounds send negative signals to the market. The path dependency of bridge financing decisions deserves particular attention. Once a company accepts bridge capital with certain terms, those terms influence all subsequent negotiations. Aggressive caps or deep discounts can make later rounds mathematically challenging or signal desperation to sophisticated investors evaluating the opportunity.

- **Signal risk** occurs when bridge rounds suggest inability to raise traditional equity at acceptable terms

- **Relationship strain** can develop if bridge terms feel exploitative or if the company fails to meet projected milestones

- **Cap table complexity** increases with each bridge instrument, potentially deterring future investors who prefer clean structures

- **Operational distraction** diverts founder attention from building the business to fundraising activities

- **Reduced negotiating leverage** in subsequent rounds if bridge investors hold conversion terms that new investors find problematic

Alternative Funding Options to Bridge Financing

Before committing to bridge financing, founders should evaluate alternative funding mechanisms that might better serve their specific circumstances. Revenue-based financing has emerged as a viable option for startups with predictable revenue streams, providing capital in exchange for a percentage of future revenue until a predetermined multiple is repaid. This structure avoids equity dilution entirely while providing the operational capital bridge financing typically serves. Venture debt from specialized lenders offers another alternative, particularly for companies with venture backing and clear paths to future equity raises.

Unlike bridge notes from equity investors, venture debt typically comes with fixed repayment terms, warrant coverage, and covenants. The structure works well for extending runway without additional equity dilution, though it requires confidence in future cash flows or funding to service the debt. Companies pursuing venture debt should expect thorough due diligence and may need existing investor cooperation. Each alternative carries distinct implications for company control, financial flexibility, and future fundraising. The optimal choice depends on company stage, revenue characteristics, existing investor relationships, and founder preferences regarding dilution versus debt obligations.

- **Revenue-based financing** suits companies with $50,000 or more in monthly recurring revenue seeking growth capital

- **Venture debt** typically becomes available after institutional equity raises and can extend runway 6-12 months

- **Asset-based lending** may work for companies with significant receivables, inventory, or equipment

- **Strategic partnerships** sometimes provide non-dilutive capital in exchange for commercial arrangements

- **Accelerators and grants** offer alternatives for earlier-stage companies or those in specific sectors

How to Prepare

- **Build comprehensive financial projections** that demonstrate exactly how bridge capital translates to improved company position. Model multiple scenarios showing burn rate, milestone achievement timelines, and projected metrics at the next anticipated funding round. Investors want to see clear logic connecting their capital to specific outcomes.

- **Document your current capitalization table** with complete accuracy, including all outstanding convertible instruments, option pools, and any special provisions from previous rounds. Bridge investors will scrutinize existing terms to understand how their investment fits into the overall capital structure.

- **Prepare a clear narrative explaining circumstances** that created the need for bridge capital. Whether market conditions shifted, a major contract delayed, or growth required more investment than anticipated, articulate the situation honestly while demonstrating how the company has adapted.

- **Establish target terms before negotiations begin** by researching current market standards and consulting with attorneys experienced in startup financing. Knowing acceptable ranges for discounts, caps, interest rates, and other provisions prevents accepting unfavorable terms under pressure.

- **Identify and prioritize potential bridge investors** starting with existing shareholders most likely to participate. Create a ranked list with specific investment amounts to request from each party, ensuring total targets provide adequate runway with buffer for partial participation.

How to Apply This

- **Initiate conversations with lead existing investors** by scheduling dedicated calls to discuss company status and bridge financing needs. Present the situation transparently, share prepared materials, and gauge interest before expanding outreach to other potential participants.

- **Negotiate term sheets with primary participating investors** to establish baseline terms that other participants will likely follow. Focus negotiations on the most impactful provisions: valuation cap, discount rate, and any special rights or provisions investors request.

- **Execute documentation efficiently** by working with experienced legal counsel to prepare convertible note or SAFE agreements. Standard documents from reputable sources like Y Combinator can reduce legal costs and speed execution when terms align with those templates.

- **Close the round and deploy capital** according to the milestones and operational plan presented to investors. Maintain regular communication about progress toward the metrics and timelines bridge financing was intended to achieve.

Expert Tips

- **Negotiate bridge terms as carefully as priced rounds** because conversion provisions directly impact equity outcomes. Many founders accept bridge terms too quickly given the instruments’ apparent simplicity, only to face unfavorable mathematics when conversion occurs.

- **Maintain open communication with all investors** throughout the bridge period, providing regular updates on progress toward stated milestones. Investors who feel informed and respected during bridge periods become advocates during future fundraising.

- **Include reasonable extension provisions** in bridge documents rather than tight maturity dates that create unnecessary pressure. Most institutional investors prefer flexibility that allows orderly resolution of timing variations.

- **Avoid multiple sequential bridge rounds** if possible, as stacked bridge instruments create cap table complexity, accumulated dilution, and market signaling concerns that become increasingly difficult to overcome.

- **Consider the full investor relationship** beyond immediate bridge terms. An investor offering slightly less favorable terms but bringing strategic value, signaling strength, or follow-on commitment may provide better overall outcomes than optimizing for bridge economics alone.

Conclusion

Bridge financing serves as an essential tool in the startup funding toolkit, providing flexibility to navigate the inevitable gaps and timing challenges that characterize venture-backed company growth. Understanding the mechanics, terms, and strategic implications of bridge capital enables founders to use this tool effectively when circumstances warrant while avoiding the pitfalls that can complicate future fundraising or company operations.

The decision to pursue bridge financing should always connect to clear strategic objectives and realistic assessments of company trajectory. When used appropriately””to reach specific milestones, close timing gaps with committed investors, or capitalize on time-sensitive opportunities””bridge financing can preserve optionality and enhance outcomes for all stakeholders. Founders who approach bridge rounds with thorough preparation, reasonable terms, and transparent investor communication position their companies to cross funding gaps successfully and continue building toward long-term goals.

Frequently Asked Questions

How long does it typically take to see results?

Results vary depending on individual circumstances, but most people begin to see meaningful progress within 4-8 weeks of consistent effort. Patience and persistence are key factors in achieving lasting outcomes.

Is this approach suitable for beginners?

Yes, this approach works well for beginners when implemented gradually. Starting with the fundamentals and building up over time leads to better long-term results than trying to do everything at once.

What are the most common mistakes to avoid?

The most common mistakes include rushing the process, skipping foundational steps, and failing to track progress. Taking a methodical approach and learning from both successes and setbacks leads to better outcomes.

How can I measure my progress effectively?

Set specific, measurable goals at the outset and track relevant metrics regularly. Keep a journal or log to document your journey, and periodically review your progress against your initial objectives.

When should I seek professional help?

Consider consulting a professional if you encounter persistent challenges, need specialized expertise, or want to accelerate your progress. Professional guidance can provide valuable insights and help you avoid costly mistakes.

What resources do you recommend for further learning?

Look for reputable sources in the field, including industry publications, expert blogs, and educational courses. Joining communities of practitioners can also provide valuable peer support and knowledge sharing.